- +94 113 487 300

- Email Us

- Mon - Fri: 9:00 - 18:30

Zero-Knowledge proof is an interaction between 2 people. The first is called a “Prover” and the second is called a “Verifier”.

The Prover convinces a verifier that a statement is correct while providing no information or reason other than that the statement is correct.

In other words, it’s a method of authentication in which no credentials are shared, making both parties or any other party involved, impossible to steal the information.

It secures and protects your conversation so that no one else can see what you’re talking about or what files you’re exchanging.

Zero-knowledge cryptography is gaining popularity among cryptographers due to its wide range of applications.

In blockchains and cryptocurrencies, zero-knowledge proof is utilized effectively.

The phrase “zero-knowledge” comes from the fact that no (“zero”) information regarding the secret is released, yet the second party (referred to as “Verifier”) is (rightfully) persuaded that the first party (referred to as “Prover”) is aware of the secret in issue.

Here’s an example to make it easy to understand,

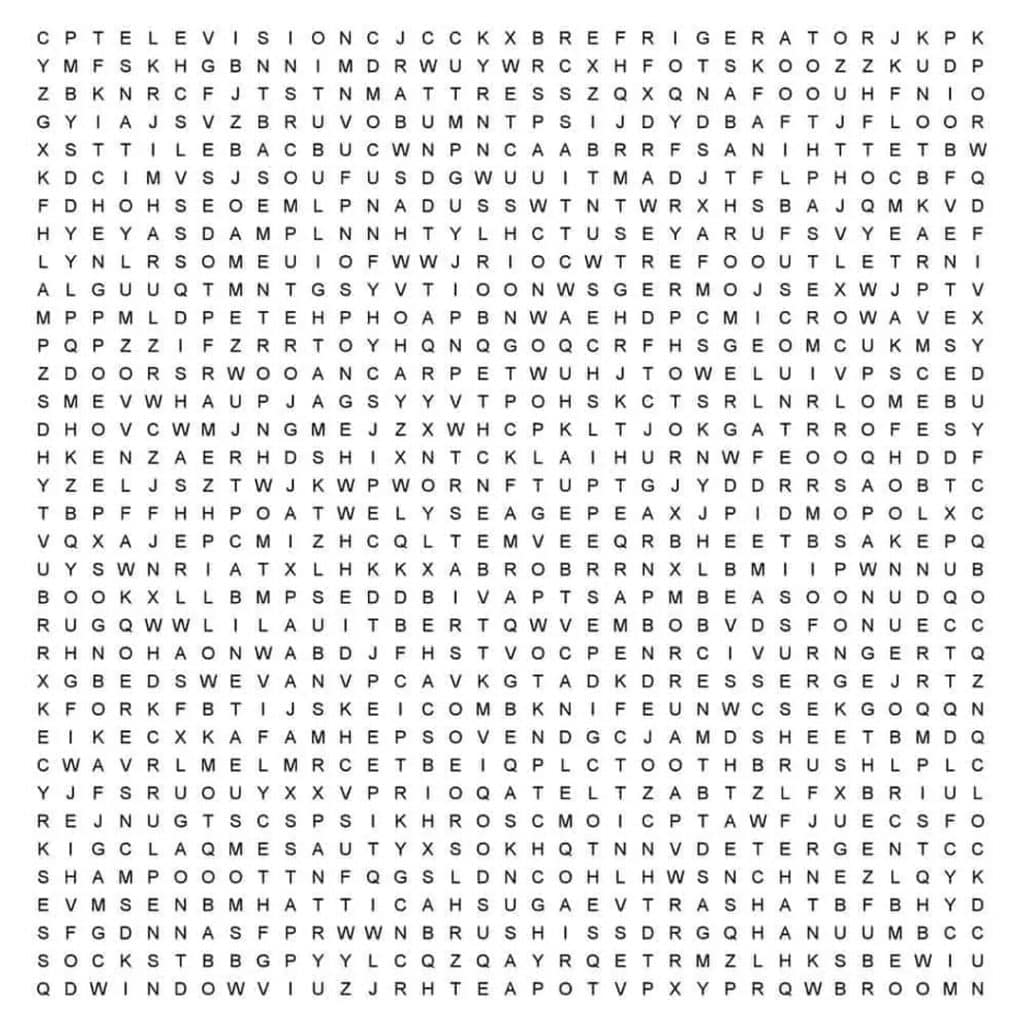

The “Prover” wants to prove that the puzzle below has the word “Towel” in it.

But the “Prover” doesn’t want to reveal the location of the word “Towel” in the puzzle to prove that the statement is true.

Hence, the prover shows the blacked out piece which does not reveals the location of the word “Towel” but proves that the word exists in the puzzle.

So the “Verifier” can verify that the statement is true by looking at the word in the blacked out piece without knowing the exact location where the word exists in the puzzle.

Provers Statement: The word “Towel” is in the puzzle below,

Below is proof that the statement “The word towel is in the puzzle” is True

Looking at the above picture the Verifier doesn’t know the exact location in the puzzle the word “Towel” exist but the Verifier is convinced that the Provers statement is true there.

It allows the prover to convey the truth of a given piece of information to the verifier without giving any other information.

Zero-knowledge methods are probabilistic evaluations, which means they don’t establish something as conclusively as releasing all of the data would.

They give unlinkable data that might be used to prove that the assertion’s veracity is likely.

Zero-knowledge proof can also help secure the transmission of sensitive data such as authentication information. It can create a safe conduit for users to use their data without disclosing it. In this method, data leaking in the worst-case situation is avoided.

Because it allows for user authentication without communicating crucial data, a zero-knowledge protocol offers a secure alternative to existing authentication techniques.

ZKPs can help developers create lightweight decentralized applications (dApps) which are outside the purview and control of a single authority to run on more common hardware devices such as mobile phones, making it possible for Web3 to be more accessible, and scalable without the need of massive computing power.

In terms of privacy, ZKPs can allow users to securely transmit information needed to get access to products and services without providing personal information that could expose them to hacking, exploitation, and identity theft.

Almost every facet of banking, lending, and trading is handled through centralized systems run by regulatory organizations and gatekeepers.

The regulations governing centralized financial institutions are defined by regulatory agencies such as the Central Bank, and the rules are amended over time by governments.

As a result, customers are unable to avoid intermediaries such as banks, exchangers, and lenders, who benefit from every financial and banking transaction.

DeFi challenges the current centralized financial system by putting essential components of today’s labor done by banks, exchanges, and insurers—such as lending, borrowing, and trading—into the hands of common people.

Here’s an example to make it easy to understand,

In Sri Lanka, you might put your savings in an online savings account and earn a 2.50% interest rate on your money.

The bank then turns around and lends that money as a Personal Loan to another customer at 4.30% (5-year term) interest and pockets the 1.80% profit.

With DeFi, people lend their savings directly to others, cutting out that 1.8% profit loss and earn the full 4.30% return on their money.

(Above data taken from Commercial Bank website on the 20th of June 2022 at 15.21PM)

Even the peer-to-peer payments such as PayPal, Frimi, PayHere, OnePay or Genie are still reliant on centralized financial middlemen (Banks) to work with the need of users to have a debit or credit card.

The main technologies that enable decentralized finance are blockchain and cryptocurrency, which implies that the system is managed without the use of a mediator or gatekeeper.

Because of its decentralized structure, many seasoned bankers and their associates are opposed to the rise of cryptocurrencies. DeFi handles transactions in the two main cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), and is powered by decentralized programs (dApps) and protocols (ETH).

Even if DeFi hasn’t been put to the test by long-term or extensive use, Peer-to-Peer transactions will undoubtedly be more secure with Zero-Knowledge Proof.

You may be wondering why a digital marketing company is researching Zero-Knowledge Proof.

Starting a business with someone that involves money and finance demands a high degree of trust in the people involved, and DAO may appear to be a safe approach to bring together more like-minded, talented people to collaborate toward a common objective based on mutual trust and funds.

Because HypeX is an internet-native firm that is collaboratively owned and governed by its members, we may work with international representatives as a digital marketing company in Sri Lanka.

This might be a safe approach to grow for a digital marketing company looking to expand into another geographic place.

The backbone of a DAO is its smart contract. The contract outlines the organization’s policies and protects the money of the organization.

Only a vote may change the rules after the contract is in place. If someone tries to do something that isn’t covered by the code’s rules and logic, it will fail.

Because the smart contract also specifies the treasury, no one may spend the money without the organization’s approval.

In DAOs, this eliminates the need for a central authority. Instead, the group makes decisions as a whole, and payments are sent automatically after the votes are passed.

We have discussed what ZKP is and how it may be used in finance and organizations in this article.

Zero-Knowledge Proof allows you to perform entirely arbitrary calculations with Zero-Knowledge.

Hope it give you some idea as to what Zero-Knowledge Proof.

We are just a call or an email away, if we can’t take you in right now we will definitely point you in the right direction. That’s our promise!

10 AM–1:30 AM

10 AM–1:30 AM

10 AM–1:30 AM

10 AM–1:30 AM

10 AM–6:00 PM

Closed

Closed

10 AM–1:30 AM

10 AM–1:30 AM

10 AM–1:30 AM

10 AM–1:30 AM

10 AM–1:30 AM

Closed

Closed

All Rights Reserved | All Wrongs Reversed |